Where does India’s oil security stand?

Oil is often referred to as “black gold” because it is the fuel that drives economic growth, and securing oil supplies is becoming increasingly crucial in a world filled with geopolitical uncertainties and the potential for supply shocks. India imports over 85% of its crude oil needs – and a rise in crude oil prices or uncertainty in supply chains can feed negatively into the economic growth engine. Recent geopolitical tensions – the possible blocking of the Strait of Hormuz, US moves in Venezuela, which has the highest proven oil reserves in the world, and the Donald Trump administration’s tariffs on India for its crude imports from Russia – all highlight the need for India to step up and focus on its energy security.

An SBI Research report last year – at the time of the Iran-Israel conflict – estimated that every $10 per bbl increase in crude oil prices can lead to a 25-35 bps increase in CPI inflation and a 20-30 bps decline in real GDP growth. However, SBI expects oil prices to soften this year, which will boost growth. Trump has been pressuring India to stop procuring crude from Russia and has even sanctioned two major Russian firms. A bill proposing 500% tariffs on countries buying Russian oil has also got a nod from the American President and will be put up for a vote in the Senate soon. India’s crude oil import basket has undergone a clear and measurable shift over the past five years, according to data from Kpler, a global real-time data and analytics provider. The Middle East still heavily dominated India’s sourcing in 2021. By 2023, the transformation was clearly visible in the data. Russia became India’s largest crude supplier, accounting for over 38% of total imports. By 2025, data shows early signs of marginal rebalancing. Russia’s share eased to around 35%, while Iraq (19%) and Saudi Arabia (13%) remained steady. Notably, US crude regained visibility with a share of about 6.5%, highlighting India’s continued effort to keep procurement diversified and flexible, especially amid periodic logistical and compliance-related uncertainties in global trade. Following the latest EU sanctions in August and US tariff and sanction actions against Russian entities such as Rosneft and Lukoil, India’s oil procurement strategy has remained pragmatic and driven by interests. “While India continues to acknowledge and factor in global sanctions frameworks, energy security and supply stability remain the primary considerations. Russian crude has continued to form a key part of India’s import basket, although volumes have eased since around December 2025 amid tighter compliance scrutiny, logistical challenges and a conscious effort by refiners to limit concentration risk,” says Sumit Ritolia, Lead Research Analyst, Refining and Modelling, Kpler.

Where Does India’s Energy Security Stand?

India imports over 85% of its crude oil requirements, indicating a high dependency on global sources. Experts say that energy security is not only vital to India’s economic growth, but it is also a strategic necessity. Is India insulated from possible global supply shocks? Sumit Ritolia of Kpler cautions that India remains structurally vulnerable to external energy shocks, as nearly nine-tenths of its crude oil requirements are met through imports. “However, the country’s overall energy security framework is stronger today than it was a few years ago,” he tells TOI. How has that been achieved? Diversification of crude procurement sources has been key to India’s energy security strategy. Sumit Ritolia explains: India has significantly diversified its crude oil sourcing base across geographies, reducing over-reliance and improving its ability to respond to supply disruptions. “Indian refiners have also enhanced operational flexibility, enabling them to process a wider range of crude grades and swiftly adjust procurement strategies in response to changing market or geopolitical conditions,” he says. Pranav Master, Senior Practice Leader and Director at Crisil Intelligence, tells TOI, “As India enters 2026, global energy markets remain volatile. With over 85% dependence on crude oil imports, energy security has become a strategic necessity rather than a policy choice. In response, India has strengthened resilience by diversifying crude sourcing from fewer than 30 countries to around 40, spanning the Middle East, Africa, and the Americas.” This diversification, backed by strong refining capacity (about 258 MMTPA) and active government measures, has greatly lowered the risk of supply interruptions and price changes for local consumers. While geopolitical risks persist, India has moved beyond being a passive price-taker and now exercises greater flexibility through procurement diversification and consistent diplomatic engagements,” he adds. Upgraded refinery capabilities now allow Indian refiners to rapidly switch among diverse Russian, American, and Middle Eastern crude oil grades based on price and compliance considerations. Advanced refining infrastructure and strict compliance systems, along with a shift towards spot-market sourcing, have driven this transition. India is also navigating the US pressure on Russian crude oil procurement by stepping up imports from the US. In fact, India’s crude oil imports from the US rose 92% in the first eight months of the current financial year! However, Russia remained the biggest supplier between April and November 2025.

India’s Crude Oil Import Basket

Sourav Mitra, Partner – Oil & Gas at Grant Thornton Bharat, says, “India has made its stand clear that it will prioritise supply security and affordability for its 1.4 billion people. India did not deter from purchasing oil from Russia despite the US imposing 50% tariffs on India.” “India is tactfully navigating the situation by ramping up oil imports from the US even as Russian oil imports stay significant in FY26. India is maintaining a diverse sourcing mix in its crude basket amidst rising geopolitical uncertainty and Trump backing the Russia sanctions bill, which proposes a 500% tariff on India,” he tells TOI. Manas Majumdar, Partner and Leader – Oil & Gas, Fuels & Resources at PwC India says that despite escalating sanctions and geopolitical turbulence, India remains relatively stable in terms of energy security, as it has had a diversified set of suppliers – with close to 40 countries in the basket. “This broader supply pool enhances bargaining power, allows for various crude quality grades and insulates against geopolitical disruptions. At one point, discounted Russian crude had grown to nearly 40% of our imports. The increase significantly eased cost pressures and reduced dependence on other sources, e.g., Venezuela, which helped in the short-term shocks. In the long term, if US sanctions on Venezuela go away and more oil flows, it can be a positive for India,” he tells TOI. Gaurav Moda, Partner and Energy Leader at EY-Parthenon India points out that given geopolitical dynamics, especially in the past few years, the government and OMCs have diversified their sources of oil across several countries and providers. “Further, the OMCs have built up the practice of keeping 3-6 months’ stocks to iron out short-term supply volatilities that have become inherent in the energy business. Such initiatives may help minimise their impact on product supplies and end consumers in the near term,” he tells TOI. Sumit Ritolia of Kpler notes one small but important movement on the domestic front: India continues to focus on strengthening its domestic supply base. “While crude oil production has not seen large step-change increases in recent years, upstream companies—led by national oil firms—have been steadily investing in enhanced oil recovery, the redevelopment of mature fields, and the exploration of new sedimentary basins to stabilise output and slow natural declines,” he tells TOI. Instead of aiming for rapid spikes in production, these efforts aim to create incremental, durable gains. Although domestic output cannot materially reduce import dependence, consistent upstream investment supports long-term resilience and helps improve energy security at the margin. “Together, having different sources for oil, keeping strategic and commercial reserves—even if they are lower than global standards—and ongoing efforts to boost local production put India in a better spot to handle the uncertain global energy situation,” he says.

What would happen if India loses its access to discounted crude?

The lucrative discounts are the biggest lure of Russian crude oil and the reason for its rising share in India’s crude oil basket. But what if, under pressure from sanctions and tariffs, Indian refiners stop procuring discounted Russian crude? The answer isn’t straightforward, though the cost would be billions: the impact on India’s crude import bill would depend on prevailing global market conditions, including supply–demand balances, benchmark prices, freight rates and the availability of alternative barrels.

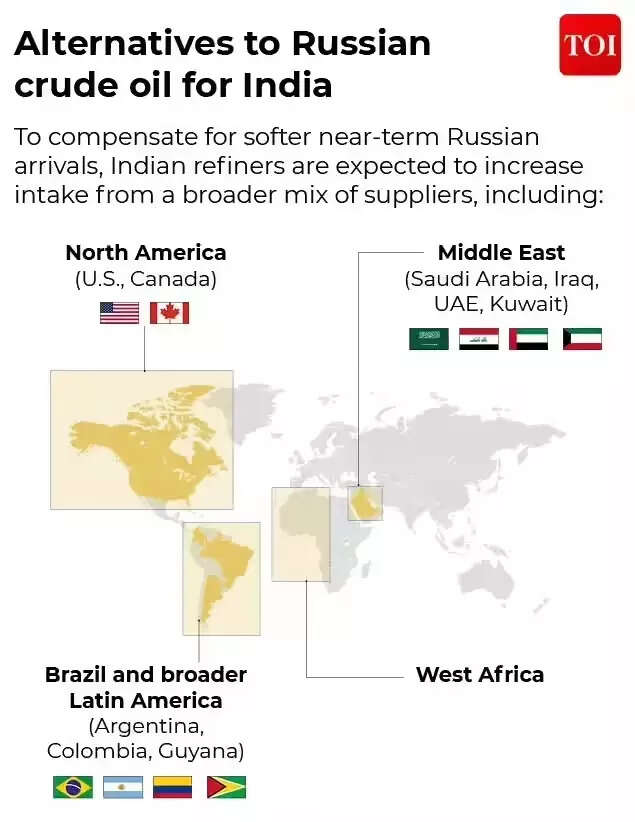

Alternatives to Russian crude

Alternatives to Russian crude

According to Sumit Ritolia, in 2025, India imported around 1.7 million barrels per day of such discounted crude from Russia, typically priced about $4–6 per barrel below other crudes in its import basket. At this differential, the cost advantage works out to roughly $3-4 billion per year. “If India had to get these amounts of crude from other sources at current market prices, the cost of importing crude would go up by a similar amount, but the exact effect would depend on price changes, costs of finding substitutes, and how well India can manage its supply sources and refinery operations,” he explains. Currently, India imports over 85% of its crude requirement, resulting in an import bill of approximately $150 billion. Given Russian crude is a few dollars discounted to Brent (at peak this discount was more than $10-15+/bbl), losing access to discounted Russian barrels could raise India’s annual crude bill by around $10 billion, says PwC’s Manas Majumdar. This estimate is based on a loss of roughly a $5‑per‑barrel discount across 1.85 mbpd that India used to take earlier; however, this quantum has reduced in recent times.

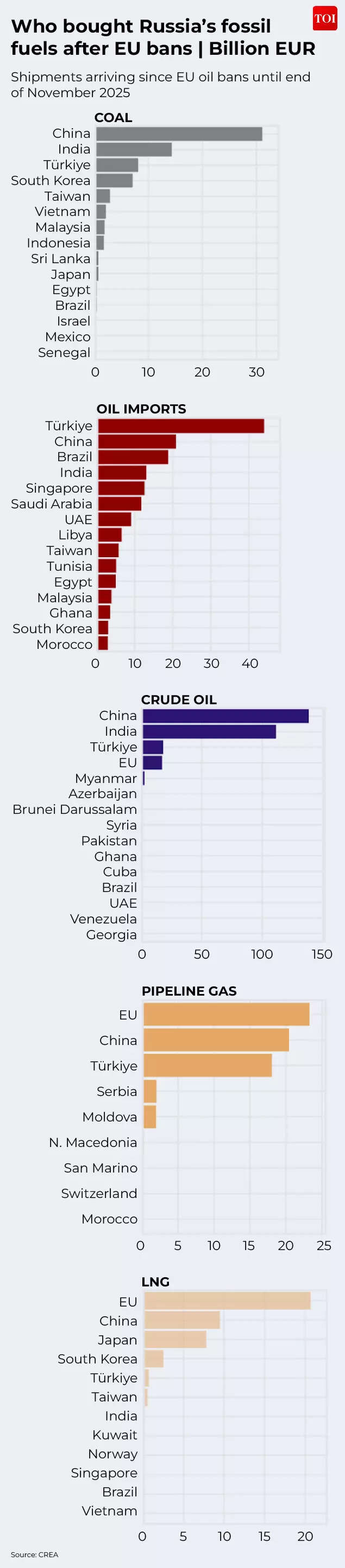

Who purchased Russia’s fossil fuels after the EU imposed bans?

Who purchased Russia’s fossil fuels after the EU imposed bans?

According to him, the reduction in discounted Russian crude could potentially impact refinery margins, particularly for private refiners. “We believe that losing these cheaper barrels would raise feedstock costs and could shave around 1–2 percentage points off refining margins,” Majumdar tells TOI.

India’s Strategic Petroleum Reserves: How Much Is The Cover?

In times of geopolitical uncertainties and supply shock possibilities, strategic oil reserves play a vital role. In the last few years, India has been moving to shore up its strategic oil reserves to a 9-day cover, which is standardly maintained by OECD countries. However, there is still a long way to go. According to Sumit Ritolia, India’s strategic petroleum reserves currently stand at about 5.33 million metric tonnes. They are spread across underground caverns in Visakhapatnam, Mangaluru and Padur. This total is around 39 million barrels, or around 9–10 days of national crude consumption.

India’s Energy Security Strategy

India’s Energy Security Strategy

“While this is a meaningful safety net, it remains well below the 90-day cover maintained by most OECD economies when combining strategic and commercial stocks,” Ritolia points out. The government has announced Phase II plans to add around 6.5 million tonnes of additional storage, but progress has been slow due to land acquisition and execution challenges, he adds. Manas Majumdar of PwC points to India’s planned expansion of strategic oil reserves at Chandikhol and Padur. In addition, new sites are being planned in Bikaner and Bina. He tells TOI that these expansions require an expedited capex allocation of around Rs 5000 crore plus. “In addition, India can diversify strategic petroleum reserves storage types, and in addition to existing underground caverns, blend with above-ground and commercial storage to enhance capacity. Additionally, it is important to strengthen the resilience of pipelines and transnational supply chains for crude oil flow, as well as to reduce potential logistics chokepoints in areas such as the Strait of Hormuz,” he says. In addition to government-held strategic reserves, Indian refiners and oil marketing companies maintain their own inventories in the form of crude and refined petroleum products across refineries, pipelines and storage terminals. Experts differ on the number of days the stocks with oil marketing companies can cover. Ritolia says that these operational and commercial stocks can typically cater to domestic demand for an additional 10–20 days, depending on market conditions and throughput. “When combined with strategic petroleum reserves, these inventories provide India with a more meaningful buffer against supply shocks, even though overall emergency cover still falls short of global benchmarks and will need to expand in line with the country’s rising oil demand,” he says. However, Pranav Master of Crisil Intelligence says that combined with storage held by oil marketing companies, the total coverage stands at around 70–75 days. “Budgetary allocation for oil purchases reflects a shift toward proactive stockpiling during favourable price cycles, strengthening India’s ability to absorb future supply shocks. Apart from conventional coastal caverns, the exploration of salt-cavern-based storage should also be considered to enhance storage capacities,” he says.

What’s The Road Ahead For India’s Energy Security?

As India builds capacity to store more strategic petroleum reserves, it is important for it to accelerate the process amidst ongoing geopolitical uncertainty that adds to the chances of supply shocks. “To better protect against global supply shocks, India needs to accelerate the completion of Phase II strategic petroleum reserve capacity and ensure that existing and new caverns are consistently filled, well-maintained and operationally ready for timely release during emergencies,” says Sumit Ritolia. He believes that as demand continues to rise, expanding strategic petroleum reserves capacity in line with consumption growth will be critical to prevent a dilution of strategic cover over time. Experts also say that India needs to continue looking beyond crude to meet the energy needs of the future. Sourav Mitra of Grant Thornton Bharat notes that India is doubling down on alternate sources of energy such as LNG, renewables, biofuels, etc. to reduce oil dependency while ensuring reliability. According to a reply in Lok Sabha by MoS Petroleum and Natural Gas Suresh Gopi: To counter the reliance on fossil fuels, the government has adopted a multi-pronged strategy to promote clean energy – it is stepping up natural gas usage, improving refinery efficiency, and boosting domestic oil and gas production. In the meantime, it is also accelerating the adoption of biofuels and clean alternatives, such as ethanol blends, bio-CNGs, biodiesel, green hydrogen, and EVs. Kpler’s Ritolia says that India would benefit from creating limited strategic reserves of refined products, such as gasoline, diesel, and aviation turbine fuel, near major demand centres, which would help manage short-duration disruptions and logistical bottlenecks more effectively. “In parallel, strengthening domestic crude oil production should remain a key pillar of resilience. While large and rapid increases in output are unlikely, continued investment in enhanced oil recovery, the redevelopment of mature fields, and the timely monetisation of discoveries can help stabilise production and deliver gradual gains. He concludes that, in addition to diversifying imports and strengthening stockholding, even incremental improvements in domestic output can mitigate margin vulnerability and enhance India’s resilience to external supply shocks. To sum it up: In a world of rising tensions, India has done well to diversify its crude basket so that temporary disruptions and choking of supply channels don’t have a long-term negative impact on the economy. Russia has only recently become a major oil supplier for India, and if it has to diversify away from it, the hit will be relatively small, though experts say Russian oil will still be available. As it looks to build strategic oil reserves, there is a need to expedite the process while also looking at non-fossil fuel-based alternatives.

One thought on “Where does India’s oil security stand?”

Comments are closed.