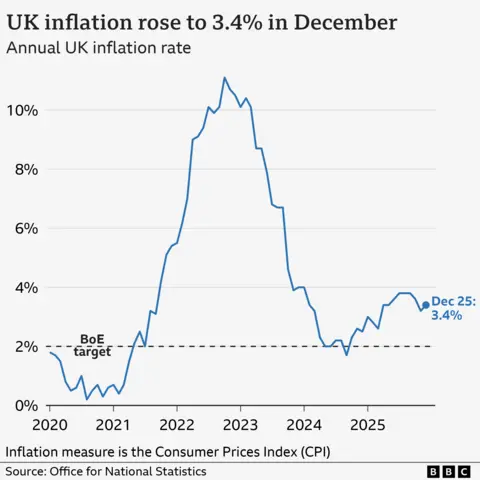

Inflation in Britain rises to 3.4% due to tobacco and airfares.

getty images

getty images

Higher tobacco prices and airfares have pushed Britain’s inflation rate higher for the first time in five months, official data showed. Growth of 3.4% in the year to December was better than expected, with most economists predicting only modest growth.

However, analysts do not think this marks the beginning of a longer, upward trend, as the December figures include one-off factors such as flight costs over Christmas and the tobacco tax increase announced in the budget.

The rise in inflation came ahead of the Bank of England’s first meeting of the year to decide on interest rates – it cut borrowing costs to 3.75% through 2025.

Inflation rose by 3.2% in the year through November and was above forecasts of 3.3%.

The meeting of the rate-setting committee of the Bank of England will be held on 5 February.

The bank’s former ratesetter, Michael Saunders, said the rise was “not the start of a new growth trend; it reflects a number of temporary irregular factors.”

He said it was unlikely the bank would reduce borrowing costs in February but expected it would announce “gradual” cuts this year.

“The reason they can’t cut early is because inflation and wage growth are still too high for comfort,” he said.

The Office for National Statistics (ONS), which published data in December, said airfares were a major contributor to inflation “due to the timing of return flights over the Christmas and New Year periods.”

Tobacco prices rose largely due to the duty hike announced in the budget on November 26.

ONS chief economist Grant Fitzner said that “rising food costs, particularly for bread and cereals, were an upward driver of inflation”.

In response to the figures, Chancellor Rachel Reeves said her priority was to cut the cost of living, citing measures in the budget, including a freeze on rail fares and prescription charges.

“There’s still a lot more to do,” she said. “But this is the year Britain has turned a corner.”

However, Shadow Chancellor Mel Stride blamed the government’s “economic mismanagement” for the increase.

He said, “Record-high tax burdens and irresponsible borrowing are stunting growth and fuelling inflation – making working people worse off.”

The data showed that some elements of inflation, such as rents, declined in December.

Housing and household services, which measures rents, slowed to 4.9% in the 12 months to November compared with growth of 5.1%.

Figures show transport prices rose 4% in the 12 months to December, mainly due to airfares.

“It’s because of the time difference,” said Sarah Coles, head of personal finance at Hargreaves Lansdowne.

He said that when the ONS calculated the average inflation rate in December 2024, “flight prices were being measured over Christmas Eve and New Year’s Eve.”

But he said that in December 2025, they were recorded on December 23 and 30.

“Prices are naturally lower on off-peak days and holidays, and when people come to leave in time for Christmas, prices become higher,” Coles said.

The 4.5% increase in prices of food and non-alcoholic beverages was mainly driven by bread, cereals and vegetables.

Balwinder Dhoot, the director of development and sustainability at the Food and Drink Federation, expressed concern that families in the region were experiencing a lacklustre Christmas due to rising costs.

“The decline in UK consumer confidence, coupled with the prospect of continued geopolitical instability, is of concern to food and drink manufacturers, who are facing rising costs and reduced budgets.”

Compared to European neighbours, Britain had a higher December inflation rate.

Inflation in Germany stood at 2% as of December –

it has been a year since UK inflation has been below Germany’s. In France the rate was 0.7%.

Sanjay Raja, chief UK economist at Deutsche Bank, predicted that UK inflation would “take a big step up in January”. He predicted that the Bank of England’s 2% target would be “in sight” by the spring.

“Indeed, we think the UK will see the largest decline in headline inflation of any G7 country this year,” he said.