The budget for 2026–2027 sets a total expenditure of Rs 53.47 lakh crore as the government strikes a balance between fiscal restraint and growth: FM Sitharaman

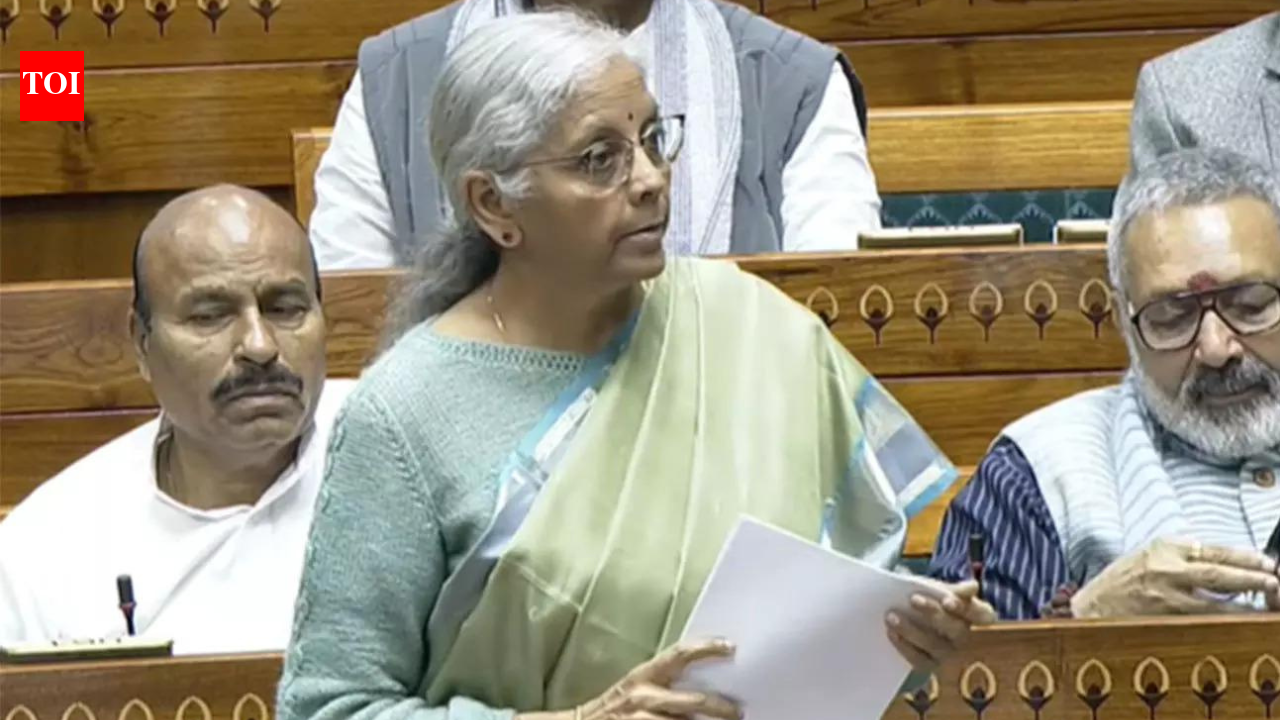

Responding to the discussion on the budget in the Lok Sabha, Finance Minister Nirmala Sitharaman underlined the government’s strategy to maintain high capital expenditure along with fiscal consolidation, saying the total expenditure in the Union Budget for the financial year 2026-27 has been pegged at Rs 53.47 lakh crore.

The revised estimate for the current financial year ending March 31 has been kept at Rs 49.64 lakh crore, down from Rs 50.65 lakh crore estimated in February 2025, PTI reported. The budget size for FY 2024-25 was Rs 46.52 lakh crore.

The government has estimated tax receipts at Rs 44.04 lakh crore for FY27, an increase of about 8% over the previous year, while total expenditure to support development priorities remains high.

The budget includes record capital expenditure incentives and support for state investments.

Sitharaman, highlighting the government’s infrastructure-led growth strategy, announced an increase in capital expenditure allocation to a record Rs 12.2 lakh crore. This is 3.1% of GDP and 11.5% higher than the revised estimate for FY 2025-26, he said.

On the recommendation of state finance ministers, the Centre has increased the 50-year interest-free capital expenditure loan under the Special Assistance to States for Capital Investment (SASCI) scheme to Rs 2 lakh crore.

With this increase, the minister estimated that effective capital expenditure will reach Rs 17.1 lakh crore, or approximately 4.4% of GDP.

Fiscal deficit and borrowing roadmap

The government has estimated the fiscal deficit for FY27 at 4.3% of GDP or Rs 16.95 lakh crore, reaffirming its fiscal consolidation path. To meet the deficit, net market borrowing from dated securities is estimated to be Rs 11.7 lakh crore.

The remaining financing will come from small savings and other sources, while gross market borrowing is estimated at Rs 17.2 lakh crore. Sitharaman said the government is focusing on reducing the debt-to-GDP ratio in line with the Fiscal Responsibility and Budget Management (FRBM) framework.

He reminded us that the government had indicated in Budget 2025-26 that it aims to bring the debt-to-GDP ratio to 50±1% by FY 2030-31.

In line with that roadmap, the debt-to-GDP ratio is estimated at 55.6% in the Budget Estimate for FY27, while it is 56.1% in the Revised Estimate for FY26. He said the decline in debt ratio would gradually free up resources for priority sector spending by reducing interest expenditure.

Boost to health infrastructure and medical hubs

The Finance Minister said that states can compete for selection for one of the five proposed Regional Medical centers through the PM Gati Shakti filter.

He stated that states have the ability to suggest integrated centres that would jointly develop medical education and patient treatment infrastructure.

These centres will establish dedicated nursing institutes and 10 allied health services to foster skill development and job opportunities. He said that, with time, these centers could develop into medical tourism centers.

Fertilizer availability and agricultural support

Addressing concerns over fertiliser availability, Sitharaman said there’s enough stock to support farmers. He said the government has allocated Rs 1.71 lakh crore for fertiliser imports to ensure continuous supply and price stability.

centre-state fiscal transfers

On fund transfers to states, Sitharaman cited the findings of the 16th Finance Commission, which analysed fund transfers between 2018–19 and 2022–23. He said, “So, we are not alone in making this claim. The Finance Commission

itself, after studying it in detail, has said in its report that the money which is to go from the Centre to the states, taking the years 2018-19 to 2022-23 as an example and examining them, has clearly said that whatever amount is to go from the Central Government to the state governments has been given.”

He assured the states that there is no room for doubt in this decision. For FY27, states’ share in central taxes is estimated at Rs 25.44 lakh crore, which is Rs 2.7 lakh crore higher than the previous year.

He also said that the cess and surcharge collection is used for development work in various sectors and the present situation is different from the 41% tax transfer recommended by the Finance Commission.

Trade deal politics and opposition reaction

The Finance Minister also responded to Rahul Gandhi’s criticism as the opposition leader regarding India’s interim trade agreement with the US. Echoing Kiren Rijiju’s comments as Union Minister, Sitharaman said,

“There is no person, regardless of their background, who can sell or buy our country.” He further alleged that the Congress-led UPA government had compromised India’s status in the WTO and criticised the governance and law and order situation in West Bengal.

Elections are to be held in West Bengal in the next two months.