Union Budget 2026: Will you pay less tax this year?

Every year the budget speech is keenly watched and heard by the common man and middle-class taxpayers, looking for the answer to one simple question:

Will my tax burden be reduced this year? Even the Finance Minister presenting the Budget is aware of the populist impact of his speech in case tax relief measures are announced. Finance Minister Nirmala Sitharaman will present the Union Budget on February 1.

Will there be changes in tax slabs and tax rates? Sitharaman, who will present her ninth budget, is also the finance minister who introduced the new income tax regime in 2020.

Choosing between the old and new income tax regimes is important and every year, taxpayers carefully calculate the tax liabilities under each before deciding which one to choose.

Over the last few years, the new income tax regime has seen many changes, and the tax liability at various salary levels has gradually reduced. It has become more attractive than the old regime.

Why was the new tax system implemented?

In her budget speech in 2020, FM Nirmala Sitharaman explained the rationale for the introduction of a new income tax regime: the need for simpler compliance. “…

The Income Tax Act is replete with various exemptions and deductions, which makes compliance by taxpayers and administration of the Income Tax Act a cumbersome process for the tax authorities.

It is almost impossible for a taxpayer to comply with the income tax law without the help of professionals,” he said. Therefore, a new and simplified income tax regime was introduced to provide “significant relief” to individual taxpayers.

The idea was to have a tax system that offers lower rates for taxpayers who give up certain deductions and exemptions. New Income Tax Regime: Tax Slabs for FY 2020-21

The biggest learning was that under the new regime, the 30% tax slab became applicable on income above Rs 15 lakh, whereas under the old tax regime it was Rs 10 lakh.

At that time, under both the regimes, individuals earning up to Rs 5 lakh did not have to pay tax with the benefit of Section 87A. FM Sitharaman explained the benefits: in the new tax regime, the taxpayer will receive substantial tax benefits depending on the exemptions and deductions claimed by him.

For example, a person earning Rs 15 lakh a year and not availing any deductions, etc., will have to pay only Rs 195,000 compared to Rs 273,000 in the old system.

Therefore, under the new system, their tax burden will decrease by Rs 78,000. Even if he was taking a deduction of Rs 1.5 lakh under various sections of Chapter VI-A of the Income Tax Act under the old system, he will still benefit in the new system.

Development of new income tax system

Over the past few years, the government has made significant changes under the new income tax regime – introduction of standard deduction benefit, higher standard deduction limit of Rs 75,000,

evolving tax slabs and tax rates. In the Union Budget 2023, tax slabs were further changed under the new regime: New Income Tax Regime: Tax Slabs for FY 2023-24

Importantly, the following major changes were introduced:

- Under the new system, the tax exemption limit was increased to Rs 3 lakh.

- The standard deduction benefit of Rs 50,000 introduced in the new regime

- Under the new system, the exemption limit of Section 87A has been increased to Rs 7 lakh, which means those earning up to Rs 7 lakh will not have to pay any tax! This limit was retained at Rs 5 lakh under the old tax system.

- The top surcharge rate was reduced from 37% to 25%, reducing the top tax rate from 42.74% to 39%.

- The new income tax system was made the default system

In the interim Budget 2024, the standard deduction under the new regime was increased to Rs 75,000.

Tax-free bonus of Rs 12 lakh

Last year, FM Sitharaman’s budget brought sweeping changes to the new income tax regime, making it even more attractive for taxpayers.

With higher exemptions, tax payments are reduced to zero on income up to Rs 12 lakh! Describing the visit, Sitharaman said, “Right after 2014, the ‘zero tax’ slab was increased to Rs 2.5 lakh, which was further increased to Rs 5 lakh in 2019 and Rs 7 lakh in 2023.

This shows the confidence of our government in the middle-class taxpayers. Now I am happy to announce that under the new regime no income tax will have to be paid up to Rs 12 lakh (i.e., an average income of Rs 1 lakh per month other than special rate income like capital gains).

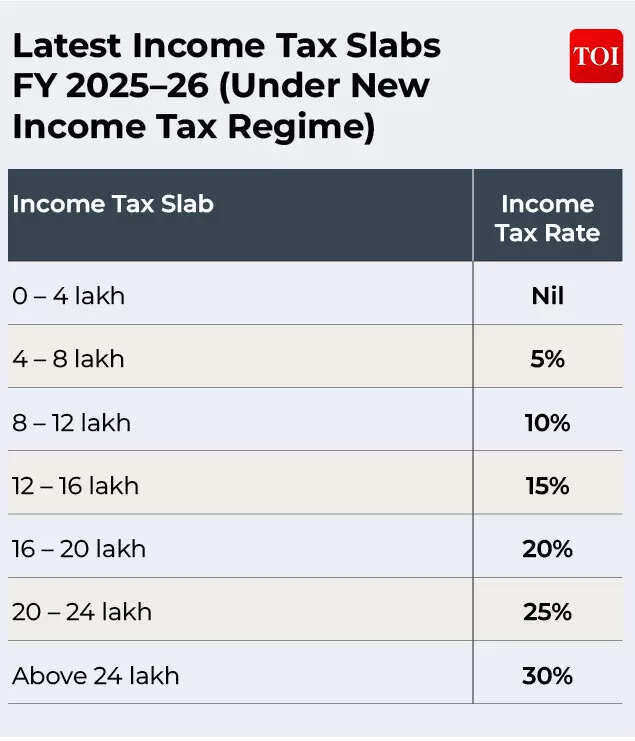

For salaried taxpayers, this limit will be Rs 12.75 lakh due to a standard deduction of Rs 75,000. Under the new system, major changes were seen in the income tax slab; now a 30% tax slab has been implemented on income of more than Rs 24 lakh, which was earlier Rs 15 lakh.

The latest income tax slabs for the financial year 2025-26 are based on the new income tax regime.

The latest income tax slabs for the financial year 2025-26 are based on the new income tax regime.

Old vs New Income Tax Regime: How Much Tax Have You Been Saving Over the Years?

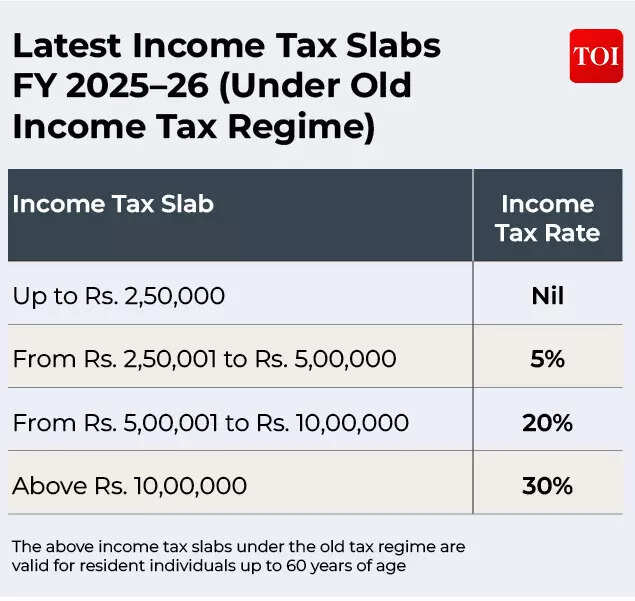

A noteworthy point is that all these years since the introduction of the new income tax regime, the old tax regime continues to function with higher deductions and exemptions as well as higher tax rates, although without any change. The government’s intention is clear: to make the new tax regime the default regime and with all the changes and benefits of lower taxes, taxpayers are being urged to adopt it.

But what is the tax benefit under the new tax regime compared to the old regime? Tax expenditure has changed over the last 5 years, and at different income levels, tax expenditure under the new regime has become significantly lower than under the old tax regime.

For a better understanding, we will look at how tax expenditure has changed over the last five years at different income levels of Rs 10 lakh, Rs 20 lakh and Rs 40 lakh.

If for an income level of Rs 10 lakh, you had to pay Rs 75,400 in FY21 under the old tax regime, under the new regime the tax expenditure has come down from Rs 78,000 in FY21 to Rs 54,600 in FY24, and from Rs 44,200 in FY20 to nil in FY26! Under the old system it is still Rs 75,400.

Similarly, if for an income level of Rs 20 lakh, you had to pay Rs 366,600 in FY21 under the old tax regime, the tax expenditure under the new regime will come down from Rs 351,000 in FY20 to Rs 296,400 in FY24, and from Rs 278,200 in FY20 to FY26.

It has become Rs 192,400! In FY26, choosing the new regime instead of the old regime will result in tax savings of Rs 174,200 for you! Its effect is visible even at higher income levels.

If, for an income level of Rs 40 lakh, you had to pay Rs 990,600 in FY21 under the old tax regime, the tax expenditure under the new regime will come down from Rs 975,000 in FY20 to Rs 920,400 in FY24.

from Rs 902,200 in FY20 to Rs 787,800 in FY26. It’s Rs! So in FY26, if you choose the new regime instead of the old regime, your tax saving will be Rs 202,800! These charts have been prepared by EY based on the following assumptions:

- Under the old tax regime, the Section 80C deduction (maximum Rs 1.5 lakh) is considered.

- Other deductions/exemptions like medical insurance, home loan interest, and house rent allowance are not considered.

- The standard deduction of Rs 50,000 under the old regime and the standard deduction notified from time to time (Nil, Rs 50,000, Rs 75,000) are considered under the new regime.

The above charts are broadly indicative, and the tax paid will depend on your income level and the amount of deductions and exemptions you claim.

The old system may be more suitable at different salary levels for individuals with an income above Rs 12 lakh and a certain amount of deductions and exemptions.

So, while the above examples paint a clear picture of how tax benefits have increased over the years under the new regime, for a better understanding, it is important to calculate the total amount of deductions and exemptions you availed.

For example, in the existing tax slabs in the old and new regimes, if your gross income is more than Rs 24.75 lakh, the old regime applies only if your total deductions and exemptions exceed Rs 8 lakh. This level of deductions and exemptions is for the 30% tax slab.

This will vary for income less than Rs 24 lakh. Amarpal Chaddha, tax partner, EY India, tells TOI, “Over the past few years, the new tax regime has markedly boosted the take-home pay of most salaried taxpayers due to the rising basic exemption limit and lower slab rates.

In FY 2020-21, for income up to Rs 10 lakh, the tax liability under the new tax regime was slightly higher than under the old tax regime.

However, over the next five years (FY 2021-22 to FY 2025-26), the reforms have reversed this picture, resulting in a saving of Rs 75,400 in FY 2025-26 under the new tax regime compared to the old tax regime.”

“For incomes of Rs 20 lakh and Rs 40 lakh, the savings compared to the old tax regime in FY 2025-26 are approximately Rs 1.74 lakh and Rs 2.02 lakh.

Now, if we compare the savings under the new tax regime over a six-year period (FY 2020–21 to FY 2025–26), the savings have increased significantly—at an income of Rs 10, it is approximately Rs 78,000 lakh, Rs 1.58 lakh at Rs 20 lakh, and Rs 1.87 lakh at Rs 40 lakh.

With a large number of taxpayers defaulting/moving on to the new tax regime, further slab adjustments in Budget 2026 could accelerate this trend,” he further said.

While a certain percentage of taxpayers continue to benefit from the old tax regime, for example, those who claim higher levels of house rent allowance or who have home loans, more than 70% of tax returns filed for AY 2024-25 were under the new regime.

While tax experts expect more taxpayers to switch to the new income tax regime in the current financial year, the zero tax level of Rs 12 lakh will motivate many to make the switch. However,

Experts say the government may consider introducing some popular deductions and exemptions like Section 80C and home loan interest benefits to encourage savings and housing.