Impact of Trump’s sanctions: India’s imports of Russian crude oil are expected to fall to a 4-year low, but how long will the decline last?

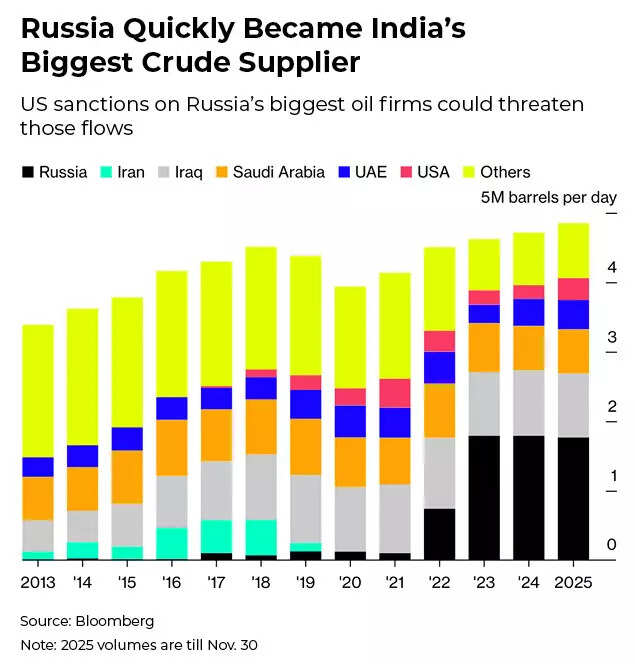

Donald Trump’s sanctions on Russian crude majors may have the effect of India’s oil imports from Russia dropping to a four-year low in January 2026. The Trump administration has been piling pressure on India to stop procuring crude oil from the country.

Of the 50% tariffs that the US has imposed on India, 25% are for its crude oil imports from Russia, which the Trump government claims indirectly helps fund the war against Ukraine. While the 50% tariffs don’t seem to have impacted India’s imports of Russian crude,

The sanctions on Rosneft and Lukoil announced in October have forced Indian refiners to look for alternative sources, though the option to purchase non-sanctioned Russian oil remains open.

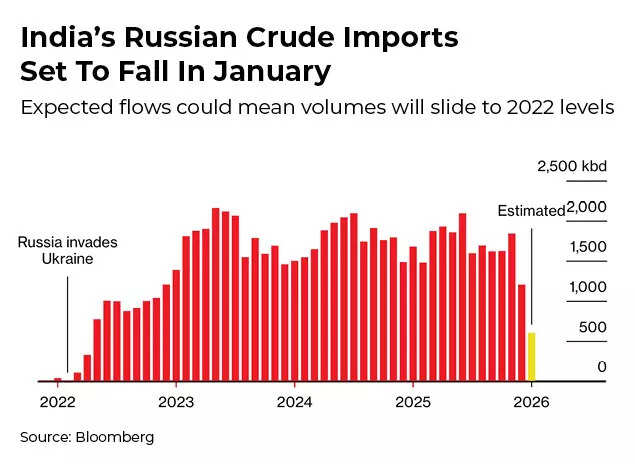

India’s crude oil imports from Russia are set to drop.

While the crude oil imports are set to drop, the important question is, for how long will this be the case? According to a Bloomberg report, Russia is cranking up its own charm offensive, and alternative channels of procurement may emerge.

India’s Russian crude imports are set to fall in January.

Deliveries of Russian oil to India are projected to decrease to around 600,000 barrels per day next month, individuals involved in the transactions told Bloomberg. They may reach the lowest point since early 2022, when the Russia-Ukraine war began. Nevertheless, these oil import projections remain higher than pre-conflict levels.

What’s next? Will India completely stop Russian crude imports?

In the past, India has benefitted substantially from global restrictions on Russian crude sales, emerging as the main purchaser of Russian seaborne crude amidst price reductions due to sanctions.

Indian imports peaked at approximately 2.1 million barrels daily in June, making up about 45% of total crude imports. Refiners and traders suggest volumes could go up as non-sanctioned suppliers enter the market and new trading intermediaries emerge.

Additionally, Russian President Vladimir Putin visited Delhi this week to discuss trade relations, offering assurances of “uninterrupted shipments of fuel”.

Russia Quickly Became India’s Biggest Crude Supplier

India’s negotiations for a US trade agreement have progressed slowly, reducing the pressure to align with Washington’s positions, the Bloomberg report said. US President Donald Trump recently indicated a potential reduction in punitive tariffs on India. Elisabeth Braw, a senior fellow at the Atlantic Council, told Bloomberg, “While US sanctions create obstacles,

They cannot completely halt the trade. She noted that purchasing decisions are based on product suitability and pricing, rather than ideological alignment with Russia, and hence would likely continue. Restrictions on India’s imports of Russian oil have intensified since July, starting with the European Union sanctions imposed on Nayara Energy Ltd.

which has Rosneft backing. This marked the EU’s first such measure. The Trump administration subsequently shifted from its previous acceptance of purchases under a Group of Seven price cap, openly criticising the trade and implementing a 50% tariff to enhance its exports and apply pressure on Putin.

The implementation of the levy and subsequent sanctions on Rosneft and Lukoil have not completely halted oil flows, despite significantly impacting trade. Concerns about potential future disruptions led to increased November imports of 1.8 million barrels daily, as transactions were expedited. Also read: Message for Trump?

Putin says Russia ready to continue ‘uninterrupted shipments of fuel’ to India; pitches reliable supply of oil According to Sumit Ritolia, lead analyst for refining and modeling at Kpler, December volumes are expected to range between 1 and 1.2 million barrels per day, reflecting the surge in bookings by refiners prior to the sanctions’

implementation. Although the government has not provided official directives regarding Russian crude, state refiners have adopted a cautious approach towards sanctions. Mangalore Refinery and Petrochemicals Ltd, and HPCL-Mittal Energy have stopped purchases entirely, whilst Indian Oil Corp and Bharat Petroleum Corp are accepting only restricted, non-sanctioned quantities.

the report said. The extended timeline for Trump to finalise the agreement creates additional opportunities to evaluate the economic and political implications of reducing discounted oil purchases. “If the deal drags on, then more and more people will find ways or more pathways will be made, to enable such non-sanctioned barrels to still be bought legitimately by the Indian purchasers,” said June Goh.

senior oil market analyst at Sparta Commodities. Indian refiners have shifted to costlier Middle Eastern crude oil varieties to compensate for Russian supplies. They’ve increased their US oil purchases whilst checking sources in Guyana and Brazil to offset the shortfall. The sudden change led to higher shipping costs and vessel scarcity. Meanwhile, Russia faces financial pressure, with their crude selling at merely $40-$45 per barrel after discounts.

industry sources report. A decline is expected in January, raising concerns about whether China, the other significant purchaser, can absorb the excess supply. Future trends will be influenced by various factors, including Trump’s flexibility on tariffs, alongside the swift development of alternative arrangements as supply networks are restructured and price reductions become more

substantial. Over the past few weeks, several new entities have emerged in port documentation as suppliers of Russian crude to Vadinar, including Eastimplex Stream FZE, Grewale Hub FZE and Tyndale Solutions FZE. “Indian refiners may also gradually find ways to shift towards non-sanctioned Russian entities,