How to Make ESOPs More Valuable for Startup Staff

As India’s startup ecosystem matures, Employee Stock Option Plan (ESOP) remains one of the most effective tools to attract and retain talent.

For young companies operating with limited cash flow, ESOPs help balance ambition with affordability.

However, how these stock options are taxed plays a decisive role in how valuable they are to employees.

How ESOP tax deferment works for startups today is crucial to understand.

ESOPs are generally taxed first as salary at the time of exercising the option and then as capital gains at the time of selling shares.

Since at the point of exercise, tax is levied on a notional gain (fair market value of shares minus the price paid by the employee), it creates a liquidity crunch for employees.

To address this challenge, the government introduced a targeted tax relief for employees of eligible startups in 2020 to mitigate the liquidity mismatch caused by ESOP taxation.

This benefit is only applicable to employees of startups eligible under Section 80IAC of the Income Tax Act,

which stipulates conditions such as the startup being incorporated as a private limited company or LLP between April 1, 2016, and March 31, 2030, and being less than 10 years old.

The startup must have an annual turnover that does not exceed Rs 100 crore in any year since its incorporation, obtain certification from an inter-ministerial board, and meet other relevant conditions.

Under this provision, when an employee of an eligible startup exercises an ESOP,

The tax arising at that stage is not required to be paid/deducted by the employer immediately. Instead,

The tax is deferred and becomes due within 14 days of one of the following events:

- Forty-eight months (4 years) from the end of the relevant assessment year

- Date on which employee sells shares

- The date on which the employee leaves the company

Limit: who gets the benefits

While the intention behind the provision has garnered widespread appreciation,

Only a small group of startups can benefit from an ESOP tax deferment.

particularly those recognised by the Department for Promotion of Industry and Internal Trade (DPIIT) and certified by the Inter-Ministerial Board.

.

.

Currently, DPIIT recognises around 197,000 startups, but only a little over 3,700 can offer relief to their employees.

Why is comprehensive coverage needed?

Startups today operate in a highly competitive talent market, especially in areas such as technology, artificial intelligence, fintech and deeptech.

Cash compensation alone is often insufficient to attract and retain skilled professionals, making ESOPs an important part of compensation structures.

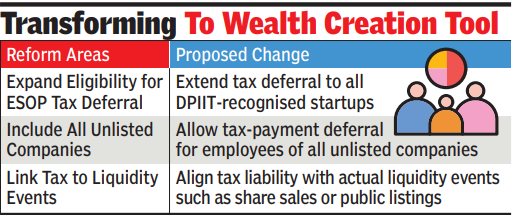

Looking at the budget, the priority should be on reforms that make ESOPs more practical and truly valuable to startup employees.

One of the key measures will be extending the tax moratorium to all DPIIT-recognised startups.

Extending tax-payment deferment benefits to all unlisted companies, except startups, will go a long way in making ESOPs a far more attractive component of employee compensation.

An overarching objective should be to align tax payments more closely with actual liquidity events, such as the sale or listing of shares, wherever possible.

Collectively, these steps will help transform ESOPs into a genuine long-term wealth-generation mechanism rather than a short-term financial burden.

(Chaddha is a tax partner at EY India; Shanmuga Prasad, senior tax professional at EY India, also contributed to the article.) Views are personal.)

One thought on “How to Make ESOPs More Valuable for Startup Staff”

Comments are closed.