Tariff-eyed? Not anymore! Exporters want to cash in on duty benefits

New Delhi: Mrs Bectors Food Specialties’ new plant in Indore had just started production for some US buyers when the US announced 50% tariffs on Indian imports.

With the trade agreement likely to come into force soon, the company is now hopeful that things will gradually recover.

Anup Bector, the MD of the company, stated, “We halted the business under development, but we will now start the project immediately.”

He said that now they also intend to work on the distribution network in the US and open warehouses.

We are expecting to triple our exports to the US in two years,” he said.

Mrs. Bectors Food Specialities, maker of Cremica and English Oven brand biscuits, exports biscuits and cookies worth about Rs 100 crore to US retailers and had to face a hit of about 5–7% by offering discounts to offset the impact of the tariffs.

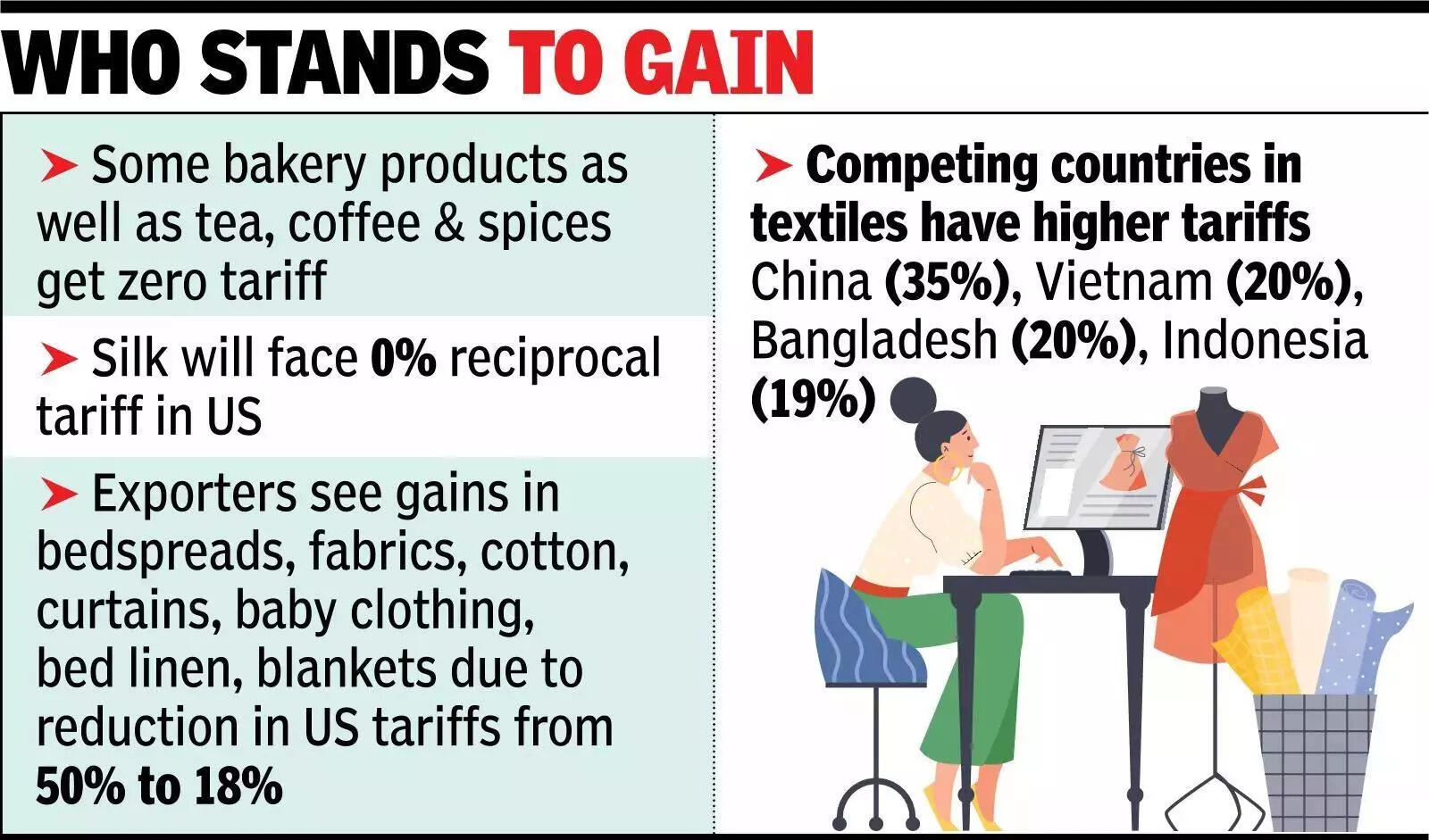

While the US is going to provide duty-free access to some Indian bakery products, Bector is waiting for the list.

Tea producers are also celebrating duty-free access, especially due to their tariff advantage compared to competitors from Sri Lanka, Kenya, and China.

Sri Lanka suffered losses due to its ‘oil for tea’ barter agreement with Iran, which resulted in a 25% tariff penalty. Kenya, which enjoyed duty-free access under AGOA, now has to contend with a 10% baseline reciprocity tariff.

“The ‘Golden Letter’ exemption restores the price competitiveness of Indian orthodox and speciality teas against rivals such as Kenya and Sri Lanka.

By securing zero-duty access, while Sri Lanka is stuck at 25% and Kenya at 10%, India effectively becomes the lowest-cost premium producer for the North American market.

Moreover, with sharp tariffs of 33–35% on Chinese tea, India has a historic window.

While we currently produce small quantities of green and oolong tea, this tariff benefit provides the right incentive for Indian estates to diversify and become a major exclusive supplier to the US.”

This was stated by Ajay Jalan, the Managing Director of Mokalbari Kanoi Tea Estate. Many exporters will get clarity when US buyers return to offices on Monday, especially those offering deep discounts and goods in transit.

Texport Industries’ CMD, Narendra Goenka, is interested in understanding the future of discounts on goods in transit or ready for shipment. Most players in the textile business were offering a 15%–18% discount to retain buyers.

With tensions rising in Iran, some buyers were becoming even more worried, but we somehow managed to retain most of them, although we lost a few orders, which we have to work on,” Goenka said.

Most textile companies have seen their profits take a hit due to heavy discounting so they can retain buyers and have to lay off many workers.

“This will be the first time in many years that the balance sheet will show a loss. We were doing minimal business, but now the volumes will come in a big way,” says Puran Dawar, an Agra-based leather footwear exporter.

In Tiruppur, KM Knitwear CMD KM Subramaniam is looking at enquiries from buyers and is expecting exports to reach last year’s levels after losing almost half of US orders in the last few months due to tariffs. But he is unsure whether buyers will accommodate orders.

“This is a buyer’s market; we may seek compensation through a 3-4% price increase in new orders,” he said over the phone.

With the joint statement signed over the weekend, the companies have a lot more clarity talking to their buyers in the US.

The reduction in additional tariffs from 50% to 18% is expected to ensure that many factory jobs, which would have been lost as buyers moved orders out of India, are now protected.